Introduction When it comes to investing, one size does not fit all. Every investor has a unique set of financial goals, time horizons, and levels of comfort with risk. Understanding your risk tolerance is a crucial step in building an investment portfolio that aligns with your personal needs. But what exactly is risk tolerance, and how can you find the right investment mix for you? Let’s explore.

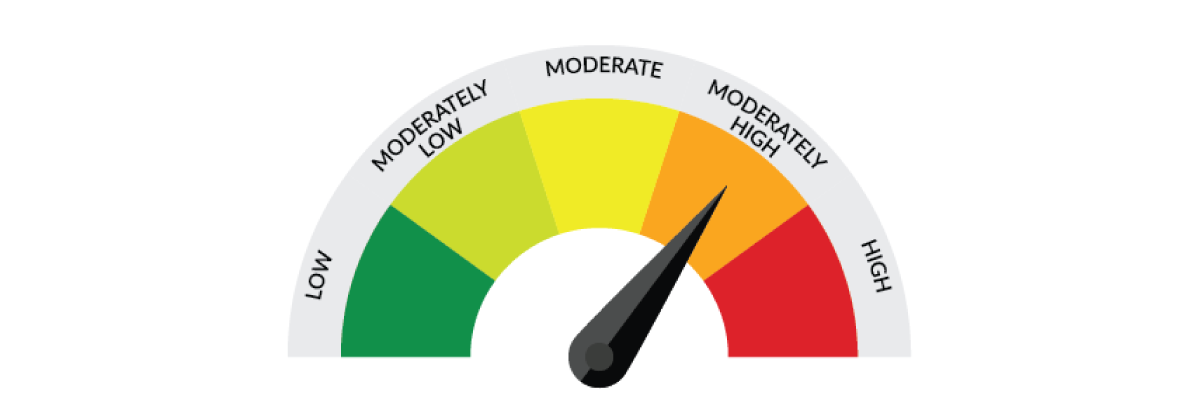

What is Risk Tolerance? Risk tolerance is your ability and willingness to endure the ups and downs of the market in pursuit of your financial goals. It’s about how much volatility you can handle without panicking or making hasty decisions. Your risk tolerance can be influenced by several factors, including your financial situation, investment goals, and personality.

Why Understanding Risk Tolerance Matters Understanding your risk tolerance is key to choosing the right investments. If you take on too much risk, you might find yourself stressed and tempted to sell when the market dips. On the other hand, if you’re too conservative, you might miss out on opportunities for growth. Finding the right balance is essential to achieving your financial goals without unnecessary stress.

Assessing Your Risk Tolerance

Finding the Right Investment Mix Once you’ve assessed your risk tolerance, it’s time to build an investment portfolio that reflects your comfort level with risk. Here are a few options to consider:

Rebalancing Your Portfolio Risk tolerance isn’t static; it can change over time as your financial situation and goals evolve. That’s why it’s important to periodically review and rebalance your portfolio to ensure it still aligns with your risk tolerance. If your risk tolerance has decreased, you might want to shift towards more conservative investments. If it’s increased, you could consider adding more growth-oriented assets.

Understanding your risk tolerance is essential for making informed investment decisions. Analyzing your risk profile is not a tedious job and can be finished off in a few minutes. You can get your FREE risk profile analysis by simply answering the questionnaire of your investment advisor. Advanced algorithms analyze your answers to provide insights into your risk capacity.

By assessing your financial situation, identifying your goals, and reflecting on your comfort with risk, you can find the right investment mix that suits your needs. Remember, investing is a journey, and it’s important to stay flexible and adjust your strategy as your circumstances change. With the right approach, you can build a portfolio that not only meets your financial goals but also gives you peace of mind.