Global Economy

• The United States is expected to grow at a 5% rate in 2021 on the back of stimulus packages and strong investments made in the

latter part of 2020.

• Economic activity spillovers from advanced economies as a result of the US fiscal support.

• The Eurozone is expected to grow at a rate of 4.2% in 2021.

• East Asia and Pacific is projected to grow at 7.4% in 2021.

• China is expected to increase their growth by 7.9% due to an unusually strong global demand.

• The Middle East is also expected to record a 2.1% growth in 2021 as a result of easing lockdown restrictions and increase in the global oil

demand.

• Sub-Saharan Africa is projected to grow at 3.2% in 2021 which is expected to be driven by improvement in exports and commodity prices due to the recovery of the world economy.

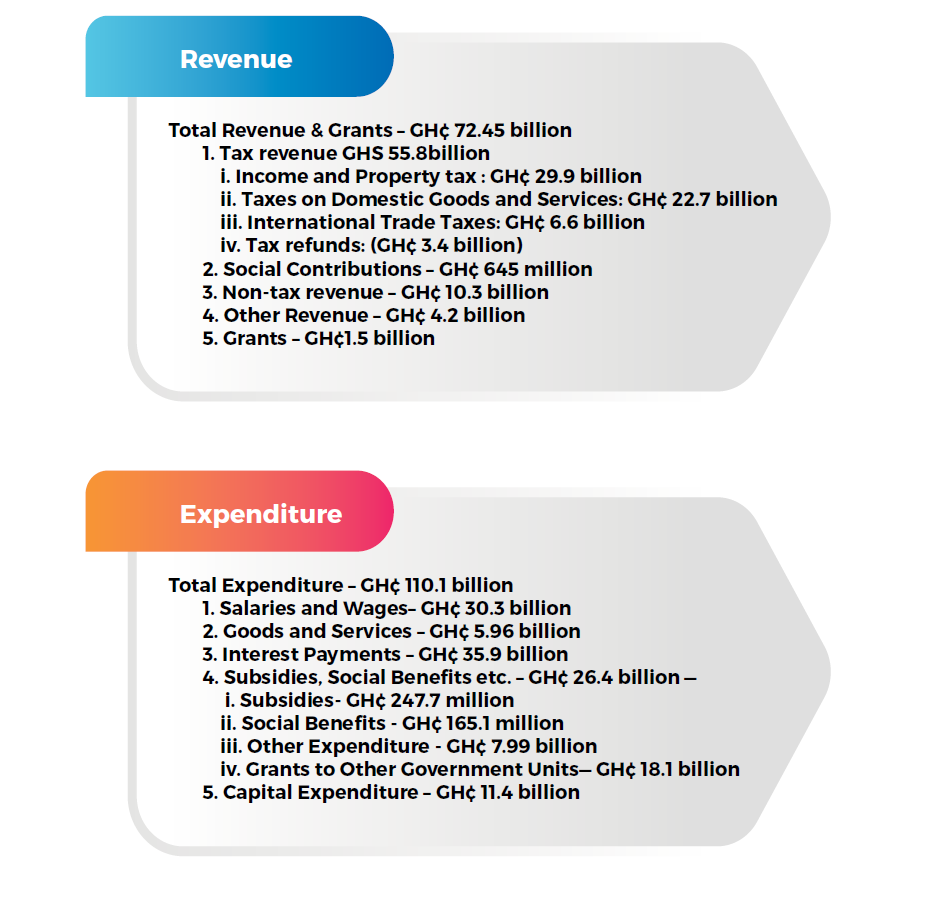

Revenue Mobilisation

1. Energy Sector Recovery Levy of 20 pesewas per liter on petrol/diesel under the Energy Sector Levies Act (ESLA)

2. Sanitation and Pollution Levy (SPL) of 10 pesewas per liter of petrol/diesel under the Energy Sector Levies Act (ESLA)

3. Financial Sector Clean-up Levy of 5% on profit before tax of banks

4. COVID-19 Health Levy: 1% increase in National Health Insurance Levy (NHIL) from 2.5% to 3.5% and 1% increase in Value Added Tax

(VAT) Flat Rate from 3% to 4%.

5. Automatic annual adjustment of road tolls through a proposed amendment to the Fees and Charges (Miscellaneous Provisions)

Act, 2018 (Act 983)

Tax Reliefs

1. Permanent tax-exemption of capital gains on listed securities

2. Provision of COVID-19 support to registered individuals or entities with the Ghana Revenue Authority who have fulfilled their first

quarter 2021 tax obligation. The Components are:

i. A penalty and interest waiver on accumulated tax arrears till December 2020

ii. 30% income tax rebate for hotels and restaurants, education, arts and entertainment, and travel and tours for the second, third and fourth quarters of 2021.

iii. Suspension of income tax payments for the second, third and fourth quarters of 2021 for small businesses using the income tax stamp.

iv. Suspension of the vehicle income tax for the second, third

Financial Sector Initiatives

• Introduction of Security Lending and Borrowing by Ghana Fixed Income Market (GFIM) – The Ghana Stock Exchange (GSE) is to

introduce securities lending and borrowing under the Global Master Securities Lending Agreements (GMSLA) which is a global standard

to make transactions of securities more effective.

• The Government is to issue an estimated US$5.0 billion on the International Capital Market Eurobonds, Diaspora Bonds, Green

Bonds & Social Bonds and Syndicated Term/Bridge Financing. The proceeds will be used to support the budget deficit through the

funding of growth-oriented expenditures.

• The Ghana Stock Exchange partners with SIGA and other private sector associations- This will result in the issuance of at least four (4)

corporate bonds and new products like green bonds and bio credit trading. The outcome will be the maintenance of Investors’ Interest

in the fixed income market.

• Introduction of Mobile Applications for Security Trading- The GSE is to partner with various FinTech companies to make security trading

accessible to the ordinary Ghanaian via mobile applications.

• Mandatory Marine Insurance with Ghanaian Insurance Companies for Imported Goods. This will ensure that Ghanaian importers can

make claims easily if they suffer accidental loss.

• Fire Insurance for Commercial Places – This will reduce the impact of risks of fire at commercial places. The Government plans to ease

the verification of insurance at commercial places by using digitized fire insurance certificates.

• Access of Micro, Small, and Medium Enterprises (MSME’s) to Insurance National Insurance Commission with ease. The Ministry of Finance, is putting together a strategy to make insurance more accessible to MSMEs which will help push significant portion of businesses in the insurance safety net.

• Additional Investment in the Venture Capital Trust Fund- There is going to be an additional US$ 45m to be invested in the Venture

Capital Trust Fund to improve access to competitive finance for entrepreneurs.

• The establishment of a Domestic Credit Rating Agency (DCRA) – which will help promote market transparency and discipline;

facilitate independent rating of regulated financial institutions and other corporate entities and issuers.

• Roll-out of Cocoa Farmers Pension Scheme model to other Informal Sectors -The cocoa farmer’s pension scheme is going to be rolled

out nationwide. And it will make provisions for a guaranteed retirement income security to all cocoa farmers. The model is

also to be adopted by other organized farmer groups and other informal sector groups like the Ghana Private Road Transport Union

(GPRTU), Progressive Transport Owners Association (PROTOA) etc.

• Enhancing Regulatory Services & Compliance Government- The Internal Audit Agency is going to enhance regulatory compliance

for public officers in the areas of Enterprise Risk Management (ERM), Risk Based Internal Auditing, Procurement Audit, Ghana Integrated

Financial Management System (GIFMIS), Financial Statement Audit and Information Technology